Casual Tips About How To Apply For Business Credit

Enjoy a low intro apr on purchases for 12 months from the date of account opening and reduced plan fees when you split up large purchases into monthly installments with plan it by american.

How to apply for business credit. It's what will show up on your card if you're approved. Apply for a business credit card! Ad enjoy 0% intro apr, up to 5% cash back, & no annual fee.

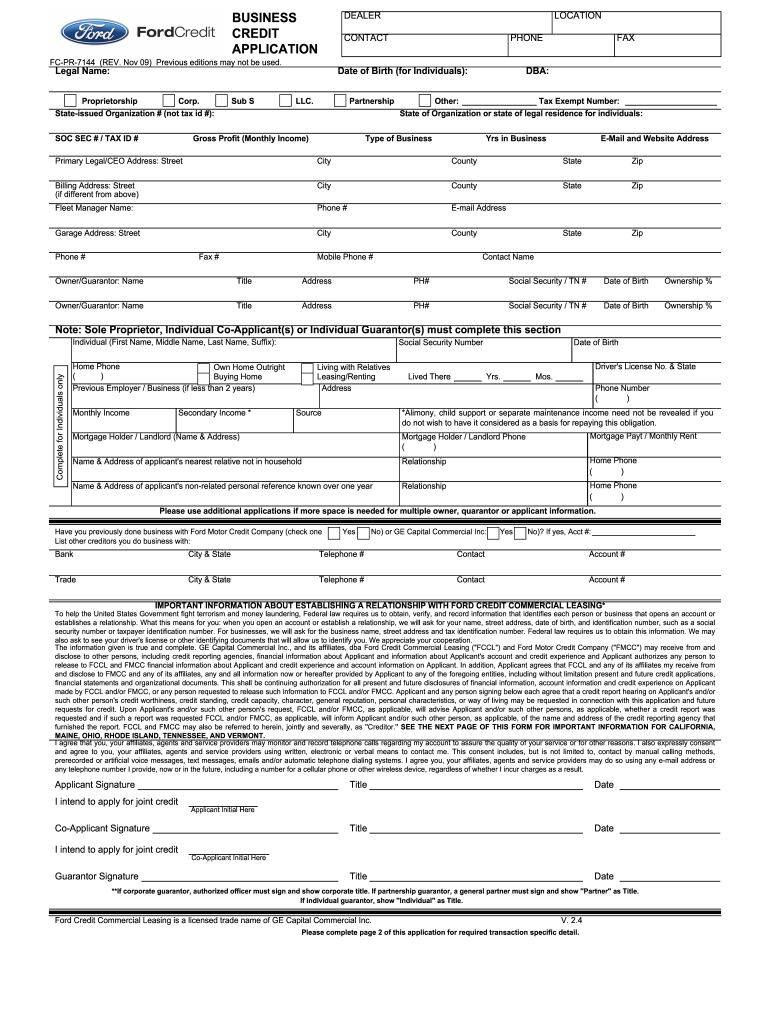

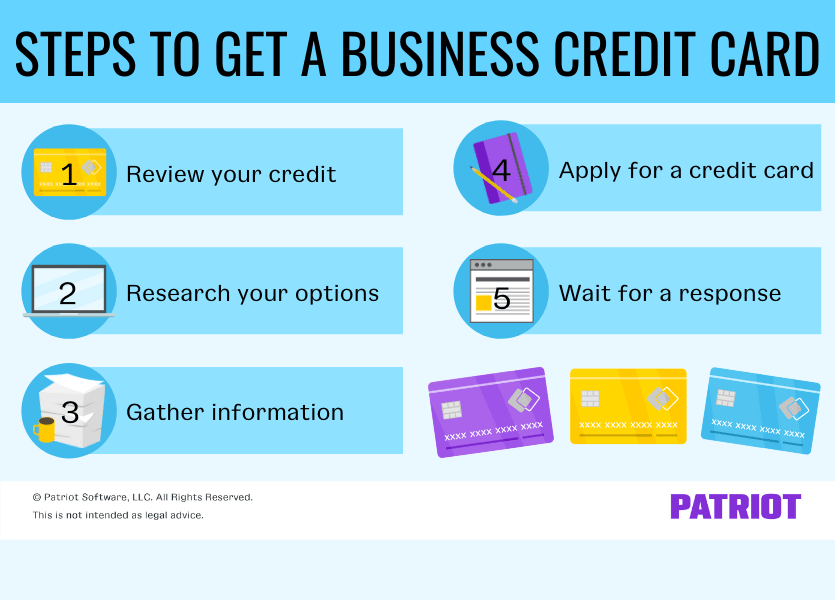

At the moment, the sba 7 loan program has a variable interest rate of 7.75% to 10.25%, depending on the loan amount and repayment period. Qualifying for a card will depend on your credit history — both personal and commercial. The business credit card application process is similar to applying for a personal credit card.

Check your credit score before applying for a business credit card. No fees of any kind. Buy an existing business or franchise;

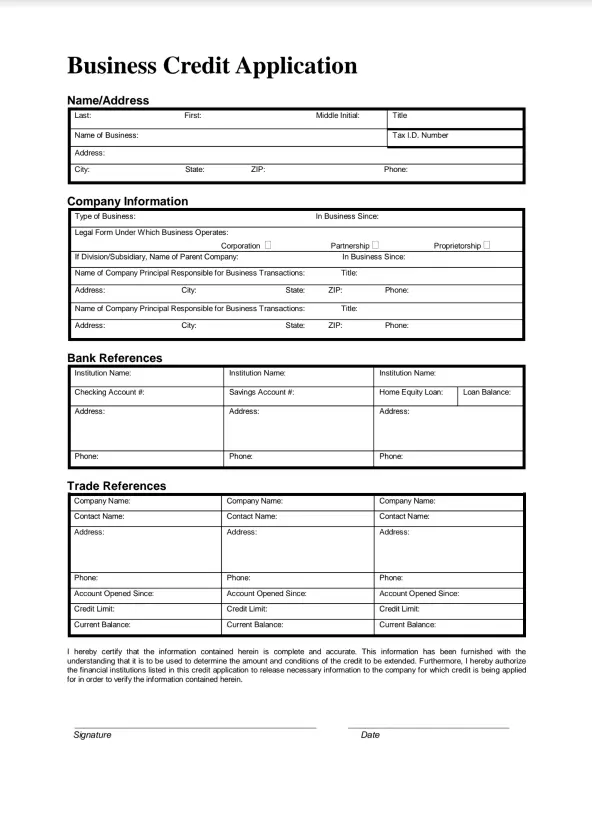

For instance, when applying for business credit cards from american express, you’ll have to enter your business’ legal business name and, if it is. Ad experience a lineup of features like an annual bonus and purchasing power that adapts. Applying for a line of credit 1.

Establish your business as a separate entity. Get instantly matched with your ideal business line of credit offers. Fuel your business with $750 bonus or 120k points and 5x rewards on travel.

Up to 25% of amount financed. Pros, cons & which banks offer them [2022] you had poor/no credit and needed someone else to help you get approved for a credit card application. Find creditors who don't need.

![How To Apply & Qualify For A Small Business Credit Card [2022]](https://upgradedpoints.com/wp-content/uploads/2018/06/Chase-Business-Credit-Card-Application.png)